Energy Security Risk Assessment: A Transatlantic Comparison

The U.S. and West Germany once shared similar energy profiles and similar global energy challenges. Through the 1960s and in the beginning of the 1970s, with largely comparable energy mixes, they both saw themselves as vulnerable to oil shocks and in 1974, were both founding members of the International Energy Agency. At that point, however, the varying political realities in the two countries, especially Germany’s energy security risk assessment, led to increasingly significant divergence in their energy security policy choices. From Willy Brandt’s Ostpolitik to the Red-Green nuclear phase out in 2000, to the more recent “energy transition,” Germany has constantly sought to actively hedge risk in its energy and energy security policy, while the U.S. has made limited, primarily technological attempts to respond to what even former oilman George W. Bush called America’s “addiction to oil” as late as 2006. Even recent technological advances in oil and gas extraction, which have redefined the American energy landscape, only threaten to postpone any policy measures that will divert the U.S. from a long-term energy independent, climate friendly future. One could say that Germany’s energy security policy is more holistic, proactive, and responsive to new realities. U.S. policy, on the other hand, puts its hope in technological advances and resists major policy measures to address outright an addiction to oil and other fossil fuels.

The German Case

Whether it be oil shocks, climate change, or nuclear disaster, Germany has proved active and adept at meeting its energy security challenges with a strategy of diversification in the types of energy and their sources. With Germany’s Wirtschaftswunder in the 1950s and 1960s, its need for oil grew along with the economy. During the Yom Kippur War and subsequent oil embargo, this dependency was exposed as a risk and a weakness. The crisis corresponded with a political shift in Germany that happened a few years before, when Willy Brandt was elected chancellor in 1969. Brandt’s new Ostpolitik (eastern policy) meant engagement with East Germany and the Soviet bloc in a number of policy issues, notably imports of Russian gas. Oil’s share in the German energy mix peaked in 1973 at 47 percent and Germany’s opening to the east meant that by 1980, Russian gas exports to Western Europe had increased 764 percent (3.4 billion cubic meters to 26 bcm) over the previous ten years.

The expansion and development of gas imports to Germany, specifically from Russia, have continued ever since. Vulnerabilities such as gas supply disruptions from the Ukraine and other Eastern European transit states have been more recently addressed through the development of the Nordstream pipeline, offering a direct gas transit supply route under the Baltic Sea. Nordstream AG, the consortium established to develop and operate the pipeline, has a high-profile board of directors, with former German chancellor Gerhard Schröder as chairman. Gas started flowing in late 2011. The project insulates Germany from disputes between Russia and its Eastern European neighbors but leaves Germany directly dependent on Russia as a supplier. It is claimed that the pipeline developed a mutual dependency, Germany needing Russian supply, Russia needing German demand; but in the interest of further risk hedging, Germany, the EU, and various other transit states have proposed building the so-called Nabucco pipeline from Turkey to Austria to hedge against this dependency.

In the 1970s, to further address oil supply uncertainty, nuclear power was also expanded and promoted. Euratom, an agency founded to coordinate European civilian nuclear power development in the late 1950s, was given a loan facility to help the European member states further their nuclear power programs in 1977. Germany built two plants with Euratom help and, while splitting atoms hardly contributed to the German energy mix at all in 1970, by the time Germany (first) decided to decommission its plants in 2000, nuclear power contributed 13 percent to its total energy supply.

While it played a factor in reducing German dependence on oil, nuclear power comes with its own set of risks, of which Germany was reminded when the Chernobyl nuclear disaster in 1986 spread radioactivity as far as Germany and parts of Western Europe. Germany’s political establishment was greatly influenced by the event and together with the rise of the German Green Party, the German nuclear risk mitigation strategy began with seeds sown in this period. While Germany’s recent decision following the Tohoku earthquake and Fukushima disaster to phase out nuclear power plants in the country by 2022 has received much attention, one must not forget that the real impetus for such a phase-out came not under Merkel’s government, but under Schröder’s, with the original Red-Green phase-out decision in 2001. Merkel’s temporary postponing of nuclear plant decommissioning by an average of twelve years and subsequent about-face less than a year later amounted to a political blunder, but what was broadly seen in the media as a rash decision on her part actually can be seen as a reversion to the original status quo and as conforming to overwhelming public opinion.

Corresponding with Merkel’s nuclear phase-out, Germany has undertaken an even more ambitious energy security risk mitigation measure: a massive development of renewable energy, the German Energiewende. Transitioning to renewables is the ultimate energy security risk mitigation measure, simultaneously addressing dependency on foreign oil and gas, nuclear disaster, and climate change. Germany is further buying itself insurance through mutualizing its risk with its European neighbors: electricity grids on the European level are being connected and expanded, integrating energy markets and allowing for Norwegian hydro, Danish wind, or, in the longer term, Spanish or North African solar power to make up the difference when the sun isn’t shining in Bavaria or the wind isn’t blowing in Schleswig-Holstein. Gas plants can be turned off and on quickly, making up for intermittency of renewable source availability and offer a suitable complement to renewable expansion in Germany. It remains to be seen at what pace Germany can overcome local “nimbyism” for the necessary grid improvements and transmission lines for its renewable transition. However, if goals of renewables making up 60 percent of the entire energy mix and 80 percent of electricity sourcing by 2050 are met, Germany (and Europe) will have made major strides in addressing and overcoming its energy security vulnerability.

The U.S. Case

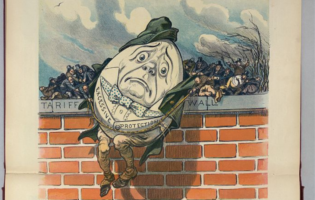

That the high price of gasoline in the U.S. is a political issue for the 2012 presidential race reflects the fundamentally different approach to energy security that the U.S. has taken in the past forty years. Similarly vulnerable to external energy shocks in the 1970s, Germany took active measures to deal with the issue, while the U.S. now finds itself embroiled in as much energy policy controversy as ever, with a continuing focus on fossil fuels. The U.S. has continuously put more stock into improved technological development, particularly in the petroleum industry. While the emergence of hydraulic fracturing (“fracking”) has recently changed the American energy outlook on a number of levels, it does not address all the risks that the U.S. faces, and continued vulnerability to external energy shocks loom.

To a large extent, energy security and attempting to address risks related to the energy supply became a political priority in the U.S. in the 1970s. Reacting to the Arab oil embargo following the Yom Kippur War, the Nixon administration created the Federal Energy Office (FEO) in December 1973 and announced Project Independence to work toward energy self-sufficiency. At the time, oil made up 49.5 percent of energy consumption in the U.S.; about 38 percent was imported from the Middle East. Despite increased interest in and funding for various alternatives and the Ford administration’s work on setting energy efficiency standards for new cars in 1975, the U.S. was still importing roughly the same percentage of its oil needs in 1980. The U.S. was also an early pioneer in nuclear energy, and as late as 1978, nuclear power was seen as one significant part of American energy expansion. However, after the reactor core meltdown of the Three Mile Island plant in 1979, nuclear power plant construction was put on a prolonged hold. De-industrialization and the corresponding shift from manufacturing to services helped the U.S. to squeeze more GDP out of the amount of energy used, but current oil prices and therefore gasoline prices in the U.S. show continued vulnerability to international shocks. The U.S. is still unable to acknowledge and respond to risks in its energy security.

In some ways, American efforts in research and development, especially in horizontal drilling and fracking in the oil and gas industry, really have made progress and are contributing to growth in American oil and gas production. Such progress, however, has failed to insulate the U.S. from external energy risks. As President Obama recently pointed out, the U.S. has only 2 percent of the world’s oil reserves but consumes 20 percent of the world’s oil market. Even increased domestic petroleum production will not make much difference in the price of the global oil market. Indeed, the price of gasoline in the U.S. is determined less by how many exploration permits the Department of the Interior approves, how much more oil the U.S. is producing, or how cheap North American natural gas is than by the global market situation. We live in a globalized world and price drivers are not exploration in the Gulf of Mexico or Arctic wildlife refuges, but rather sabre rattling in the Middle East, the vulnerability of the Hormuz Straight, and increasing demand from emerging markets. For all the effort put into lobbying for or against stricter CAFE (Corporate Average Fuel Economy) standards, such tweaks are far from fundamentally improving American energy security.

While oil plays a marginal role in the U.S. electricity market today, natural gas makes up approximately 24 percent of electricity generation. This percentage is set to expand rapidly as stricter limits on emissions from coal-fired power plants change the cost calculation of coal and gas. Fracking shale gas comes with its own environmental risks, notably to ground water supplies, but is seen as a natural resource endowment that the U.S. cannot forgo in its energy resource mix. At the same time, despite the advantages of gas (problems with fracking aside), other challenges will emerge. While oil is a globalized commodity, natural gas is harder to transport and is therefore still sold primarily in regional markets with large differences in prices between the U.S. and Europe. As natural gas and electric vehicles are still niche markets, the current price of American natural gas is of little comfort to commuters in a country with comparatively lackluster pubic transport options. Further, there are other issues on the horizon: if and when the U.S. car market is able to move away from gasoline and diesel, it is likely that natural gas transport methods will have improved enough to change global market dynamics. Over the past ten years, the U.S. has joined the world in expanding the building of Liquefied Natural Gas (LNG) terminals. Originally, demand in the U.S. was expected to exceed domestic supply and terminals were thought necessary to import gas into the country; this is now changing. The world’s increased LNG capacity is contributing to the globalization of gas markets and with the new terminal infrastructure that the U.S. is continuing to build, it will all the more easily become a gas exporter. If and when the U.S. becomes a natural gas exporter, domestic prices will rise and another sector will be vulnerable to global price volatility.

In the meantime, while the expansion of shale gas production and of natural gas-driven electricity production capacity reduce prices of electricity in the short term, they also reduce the incentive to invest in renewable resources that become comparatively more expensive when faced with a cheap gas alternative. Without further policy intervention, the U.S. will become even more unlikely to sufficiently expand its renewable energy base, although that would be is the longer-term risk hedging solution.

Conclusion

While the expansion of renewable electricity sourcing in Germany is well complemented with natural gas electricity production that can ramped up to meet peak demand or to respond to cloudy or less windy times, in the U.S., cheap gas provides a barrier to renewable electricity expansion in the first place. In the same way that American policymakers have failed to insulate the U.S. from risk and price volatility in the global oil market, in the longer term, the U.S. will face similar challenges in the natural gas market as well and have foregone the opportunity to better hedge that risk. Oil production has consistently been the single largest recipient of U.S. government subsidies accounting for almost half of all energy subsidies. Clear safety rules and their implementation for fracking are still, if at all, in early development. While American strategic oil supplies are a short-term solution, continuing down the oil and gas road contributes to a further fossil fuel technology lock-in and maintains American exposure to global supply shocks, price volatility, climate change, and other environmental risks.

While Germany and the U.S. faced similar challenges in the 1950s, 1960s, and the beginning of the 1970s, various political realities, geographies, and especially a variance in energy security risk perception have led the two countries on two very different paths. Germany has constantly addressed new challenges and realities, while the U.S. has largely made do with a continuation of the status quo that only recently changed with expanded gas production. Today there is more that divides than unites German and American energy policy and especially their energy security risk perception. Germany’s ambition makes it a pioneer on a number of levels and though its plans include risks of their own, Germany will face these on its own terms within its European framework. America and its car commuters are now feeling comparatively much more pain at the gas pump in large part due to the lack of active policy action in the energy security policy field. Though enhanced oil and gas recovery methods, including hydraulic fracturing, may offer short-term solutions, the time will come when the U.S. will need to seriously reevaluate its energy policy and take more active measures to mitigate against the weakness and significant risks posed by its continuing addiction to fossil fuels.

Aki Kachi is a Project Manager at adelphi, an environmental consultancy in Berlin, Germany.