Kicking the Can Down the Road? Fears and Expectations on the Debt Ceiling

Alexander Privitera

AGI Non-Resident Senior Fellow

Alexander Privitera a Geoeconomics Non-Resident Senior Fellow at AGI. He is a columnist at BRINK news and professor at Marconi University. He was previously Senior Policy Advisor at the European Banking Federation and was the head of European affairs at Commerzbank AG. He focuses primarily on Germany’s European policies and their impact on relations between the United States and Europe. Previously, Mr. Privitera was the Washington-based correspondent for the leading German news channel, N24. As a journalist, over the past two decades he has been posted to Berlin, Bonn, Brussels, and Rome. Mr. Privitera was born in Rome, Italy, and holds a degree in Political Science (International Relations and Economics) from La Sapienza University in Rome.

Both the ongoing partial shutdown of the U.S. Federal Government and Congress’ struggle to raise the debt ceiling are keeping investors on the edge of their seats ― unsure if and when they should run for the exits. For now, the baseline scenario remains that the United States will find a solution to the problem.

Finance ministers from around the globe, who gathered in rain soaked Washington over the past weekend for the annual meetings of the International Monetary Fund and World Bank, all stressed that the United States has no choice but to raise the debt ceiling. “We expect a deal,” German Finance minister Wolfgang Schäuble said before leaving the United States on Sunday. “They have to find a solution, have to.” Indeed, failure to do so would not only shake the world’s economy in the short term, but also have a lasting negative effect on global confidence in the United States.

“The focus has shifted away from the euro,” the President of the German Bundesbank Jens Weidmann said. He does not believe that the partial shutdown will damage the economy. “But, the debt ceiling is a different matter altogether.” European policymakers refrained from openly criticizing the United States for playing with the world’s economy ― conscious that this week could turn into a make or break moment for the recovery now under way in most advanced economies.

However, the Washington spectacle could shift expectations about the United States’ role in the world, even if a deal can be reached and a partial default avoided. Any deal would probably be only temporary and merely move the debt challenge a few months into the future. Here a few things to consider:

- The political dynamic between Republicans and Democrats is not about to change. This battle over the debt ceiling could be over soon. But the war goes on.

- The dance around the edge of the fiscal and debt cliffs will therefore continue.

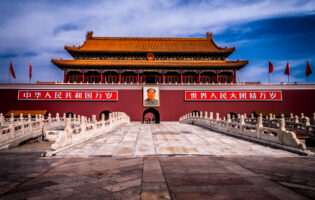

- This continued threat could add to the uncertainty that is making investors, particularly in Asia, worried about the future role of the U.S. Dollar as the world’s reserve currency.

- This situation could not come at a worst moment, as the U.S. economy is showing renewed strength, hence finally allowing the Federal Reserve to prepare the ground for a slow exit from non-standard monetary policies.

In a sign that China is accepting a larger role in the global financial order, the People’s Bank of China (PBOC, the Chinese central bank) recently opened swap lines with the European Central Bank ― a move that should promote the Chinese currency as a global currency for commercial and financial transactions. Internationalizing the Chinese currency will no doubt have lasting effects on the status of the greenback. Indeed, this dynamic will also raise new questions about the so-called exorbitant privilege of the dollar.

A shift away from some dollar-denominated assets ― in particular treasury bonds ― could be the consequence of the political stalemate in Washington, especially if the deal merely amounted to hitting the pause button.

Even a mild move, such as a minor rebalancing of portfolios by investors, could put upward pressure on interest rates. This would have an effect on the actions of the Fed. The U.S. central bank could be even more reluctant to begin the exit from unconventional monetary policies. Tapering could be off the table for a while.

Would that be a bad thing? Nobody knows for certain. What is clear, however, is the fact that central banks would like to slowly return to normalcy. Ultimately, they cannot keep their foot on the gas pedal forever without causing significant and potentially disruptive collateral damage.

Indeed, in this frustrating interplay between central banks and fiscal authorities, the latter are making sure that the former keep the liquidity taps open. Dysfunctional politics is making a return to more normal times very difficult. The debate in Washington should be no comfort for Europeans. It is only the mirror image ― albeit it with fewer actors ― of the drama they went through in the past years.